Here's a place to start research. It's a non-profit focused on military financial health and does not promote products or services.

https://usaaef.org

You won't get that much every month, though it will gradually increase. I am familiar with USNA, but I am sure USMA provides cadet guidance on the pay and automatic deductions, as well as provides financial management education.

The most important things, IMPO:

- Be clear about needs vs. wants. Your body NEEDS water, it WANTS Starbuck$$$. Your money should go toward budgeted needs first. Saving for short, mid, and long-term goals is also a NEED. After that, you can determine what is available for WANTS.

- Have a budget, know what comes in, where it goes. Your recurring expenses. Plenty of apps for that now.

- Be aware of impulse spending - why, when and how it happens.

- Understand how credit cards work, the grace period, what it really means when you carry a balance over to the next month.

- The earlier you start being responsible with your money, the better off you will be. You have 40-50 years to be in the salaried workplace, and you need to pay for yourself as you go AND have enough set aside for another 20-30 years of living expenses after that.

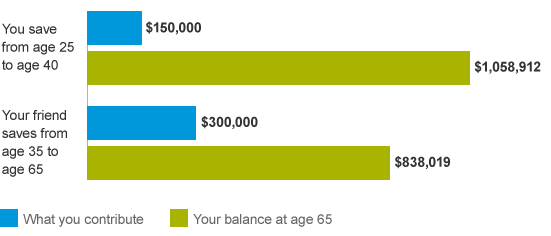

- Get a grip on the compounding power of starting early on long-term savings goals.

Good you are thinking about these things now.