I posted this in General Discussion a few days ago on a thread on this topic; it's an opinion piece.

http://www.moaa.org/Content/Publica...legis&utm_medium=email&utm_campaign=BRSLumpSum

From official sources:

http://militarypay.defense.gov/BlendedRetirement/

https://www.defense.gov/LinkClick.aspx?fileticket=QQkwCNPESKc=&portalid=1

http://www.militaryonesource.mil/footer?content_id=290760

http://www.navy.mil/ah_online/documents/1607_FAQforBRS.pdf

I am NOT an official resource on this, but the way I read it was if you raise your right hand to enter the Army before 1 Jan 2018, you will have a choice. I would love it if the sharp-eyed folks here on SAF find the details on the go-no go date for SA cadets and mids, and ROTC, or share what they are being briefed on.

My Pay Entry Base Date (PEBD) was the day I was inducted at OCS and entered active duty in an under instruction status. It counted for retirement years calculation. My promotions were based on my commissioning date several months later.

Your 4 years at USMA do not count for eligibility for a 20-year military retirement. You can count them if you go into Federal civil service and apply your SA years as part of AD years toward a civil service retirement.

One thing I am sure of - you will get briefs on this. I am sure the AD people here on SAF, as well as current cadets and mids, will have some insight on this hot topic.

I am happily well out of it, very fortunate to have the full 50% retirement plan which pre-dates the "high 3" plan.

The personnel accounts are always one of the biggest elements in the DOD budget. The military pension plan, as people retire from AD and live longer lives, requires an enormous amount of money to be earmarked for those pay streams, as well as the medical and dental retirement benefits. Very expensive to sustain. This new plan aims to give something to those not doing a full 20, and tries to save money over the long haul with those who do. It's the proverbial camel designed by the horse committee.

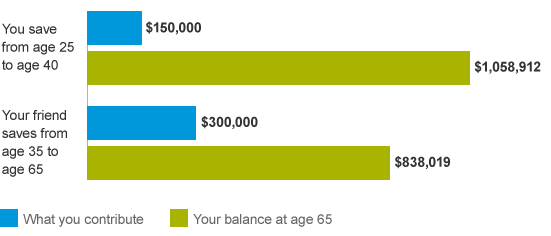

There will be a lot of concern over those who will take the lump sum and simply spend it on things that bring no return or not lay a foundation for future financial security.

@brovol makes a good point - the fact there is a defined benefit plan (non-self-contributing pension) is an increasingly rare option in the civilian world.

Two topics always of interest and life-long discussion to military and vets: pay/benefits and uniforms.